The BET index of the Bucharest Stock Exchange increased by 32.3% in 2023, with investors knowing "that they must prepare for a year full of unknowns, paved with numerous risks" in 2024, shows an XTB Romania analysis.

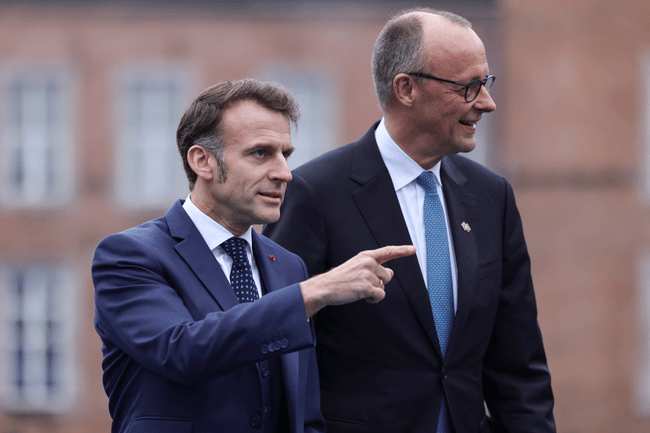

"Much of the optimism shown on the stock markets is related to the hope of a quick and consistent reduction in the cost of credits. Investors expect a decrease in interest rates in the USA in March, followed by at least 5 more stages, which will bring the interest rate to 3.75-4% in December, from the current 5.25-5.5%. This is where one of the most important risks comes from: if the inflation process proves to be difficult, fewer interest cuts would change the relaxed way in which some companies are being ranked - especially the most indebted ones and those in the growth category, which includes important names in technology," pointed out Claudiu Cazacu.

According to him, considering the difficult labour market, any shock produced in the segment of raw materials or supply chains could mean an impulse to increase inflation even more.

"Macro-level forecasts call for a mild recession in the US, or weak growth in the first part of the year. Some, however, see a more severe recession. However, there are certain signals that suggest this scenario is more likely than investors expect, such as the decrease in the quality of loan portfolios, the increase in the default rate in the automotive segment or the weak prospects offered by the carrier FedEx," the analysis shows.

Moreover, it should be taken into account the fact that only half of the companies in the S&P500 exceeded revenue expectations, although more than 9 out of 10 surprised in terms of profit.

On the other hand, the governor of the Bank of Japan is preparing for the first interest rate hike since 2007, most likely in the spring - such a move in January would be a major surprise. For the major stock exchanges, which have benefited from inflows of cheaply financed capital from Japan, this aspect could represent another unfavourable factor.

The analysis also shows that significant risks will also appear from the political and geopolitical sphere. For example, the US elections could create volatility long before the fall polls. Later, depending on the result at the polls, the American position towards the conflict in Ukraine or the Middle East could be modified, says Claudiu Cazacu.

At the same time, elections will be held in approximately 40 countries, many of which have candidates with completely different views on geopolitical, environmental or social policy strategies. The ballot boxes will also be prepared in Taiwan, which could be targeted by high pressure from China. Beijing offers more and more direct signals, both in speeches and institutional communications, as well as through military maneuvers. In this context, the risk of a possible military confrontation is increasing. Considering these aspects, central banks could continue purchasing gold, perceived as an "anchor" of portfolios in uncertain times.

According to the analysis, the winners of the AI race, Nvidia or Microsoft, will have to face a more intense competition and will have to "defend" their market value supported by a significant dose of enthusiasm.

On the other hand, the massive costs of developing and using AI models increase the pressure for their monetization. The trend of innovation should be maintained to justify the current optimism: the Nasdaq 100 had in 2023 its best year since 1999, during the speculative bubble that was followed by the loss of three-quarters of its value in less than three years.

"However, the future is full of uncertainties, so a cautious approach in building a balanced portfolio could be appropriate, in relation to the challenges, to have a margin of safety in a potentially significantly more volatile year compared to 2023," points out the strategy consultant at XTB.

Comentează