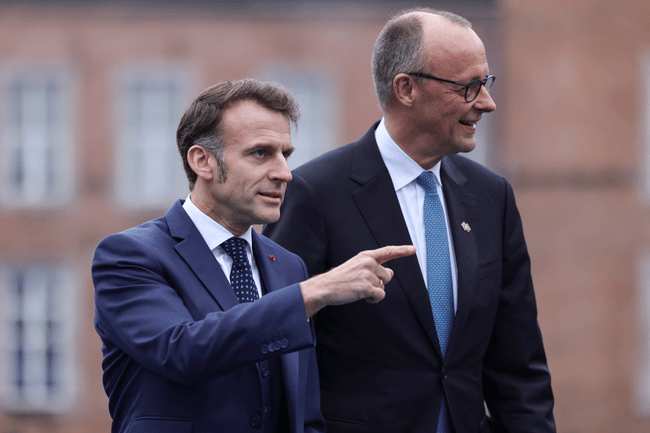

All private pension funds comply with that mandatory condition regarding the yield, a very good one, of over 4%, the president of the Financial Supervision Authority, Nicu Marcu told on Tuesday evening private television broadcaster Digi24, according to AGERPRES.

"I can guarantee you that all private pension funds comply with this yield. Moreover, the real yield is over 4%, a very good return. Even now, in crisis, because the investments made by pension funds are long-term investments. And it should be noted that the legislation on pension funds has been extremely well done, so that it does not allow pension funds to move to other, more sensitive financial instruments that can carry risks. Lately, the authority has allowed the pension funds the possibility to turn towards government securities that can reach 100%. Let's not forget that government bonds are the safest instruments on the market at the moment. That is why most pension funds are turning towards these, because they are government securities with a good yield and a very long maturity," Marcu explained.

According to him, the number of taxpayers has increased, from over seven million policyholders in 2019 to more than eight million in 2020, and assets have increased by over 14% compared to last year.

"At the moment, the pension funds are very well capitalized. They are the main investors in government securities," the ASF president stressed.

However, he pointed out that, unfortunately, the distribution of taxpayers to pension funds is currently done to a very large extent, in a proportion of 90%, randomly, which means that taxpayers do not know the legislation, where to invest, where to take their money.

"In this sense, the Authority (...) makes an aggressive promotion on all levels of the capital market and especially in private pensions, so that the citizen, when he reaches the age when he has to contribute to Pillar 2 (mandatory private pensions fund) or choose Pillar 3 (optional private pensions fund), to know which of the pension funds to choose, in order to have the best return," Nicu Marcu also said.

Asked if there is still the issue of total nationalization for Pillar 2, he gave a negative reply and stressed that it was a discussion, "an erroneous discussion and a fantastic mistake!"

Comentează