The share of revenues collected in the Gross Domestic Product (GDP) in the first eight months of the current year increased by half percentage point, which represents a progress, their level exceeding by over 20 billion lei the one achieved during the similar period of 2018, President of the National Agency for Fiscal Administration (ANAF) Mirela Calugareanu stated on Saturday.

According to her, the Value-Added Tax (VAT) refunds also increased by over one billion lei.

"The VAT refunds also increased by over one billion lei, so the trend is positive. (...) It is important to note that the share of revenues collected in the GDP during the first eight months has increased by half percentage point. It is a progress. On the other hand, of course, it's necessary to computerise ANAF and to further reorganize, restructure, modernize ANAF, but, in the short and medium term, we have initiated a series of measures to endorse and support the voluntary compliance of taxpayers in order to have the comfort of achieving the planned budget revenues. At the same time, we are taking into account a series of specific actions meant to discourage the tax evasion phenomenon," she argued.

In respect to the "VAT Gap Report" of the European Commission, the ANAF chief said that in Romania's case there are downward trends.

The ANAF President underscored that the institution initiated a series of actions along the line of compliance, especially in the VAT area.

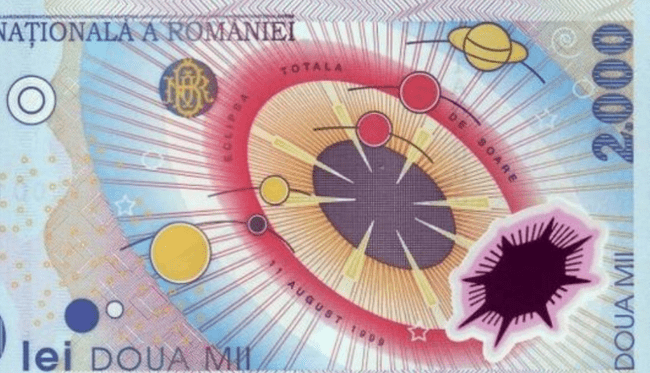

On 6 September, the European Commission published a report on the VAT collection deficit in the member states. According to the document, Romania lost 29.299 billion lei (6.413 billion euro) in 2017 from the non-collection of some revenues representing the VAT.

Moreover, Romania registered the largest VAT collection deficit at national level, 36 percent of the expected revenues from this tax not being collected in 2017. Romania is followed by Greece (34 percent) and Lithuania (25 percent). The smallest deficits are in Sweden, Luxembourg and Cyprus, where the VAT revenues are on average only 1 percent. In absolute terms, the largest VAT collection deficit of 33.5 billion euro was registered in Italy.

ANAF's Calugareanu says share of revenues collected in GDP between Jan.-Aug.2019 increased by half percentage point

Explorează subiectul

Articole Similare

0

PM says Constitutional Court's postponement of ruling on magistrates' pension bill is harmful to public opinion

0

0

Bolojan: Merger of localities in Romania is very difficult to regulate

0

1

RoPower Nuclear CEO: SMR Doicesti positions Romania as leader in next-generation nuclear technology

1

1

PM Bolojan: New Gov't will follow if the current one can no longer act or loses support

1

1

Constanta Museum showcases 'Eros the Archer' as exhibit of this month

1

5

Bucur shares to be traded on main market of Bucharest Stock Exchange

5

7

DefMin Miruta meets counterpart from Luxembourg to discuss on recent developments in security environment

7

9

Chiriac (CONAF):Technical recession is not ]main danger, if response to slowdown is to increase fiscal pressure,economy will contract

9

7

Young Entrepreneurs' Association calls for economic relaunch after technical recession

7

7

Bolojan: Appointments to Prosecutor's Office were not discussed in any coalition meeting

7

7

Last year, around 50 million euros was aid that Romania granted to Ukraine (PM Bolojan)

7

6

Romania's energy system blocked by speculative grid permits, PM Bolojan says

6

5

Tourism employers' associations and MEDAT collaborate for opening summer season on May 1st

5

Comentează