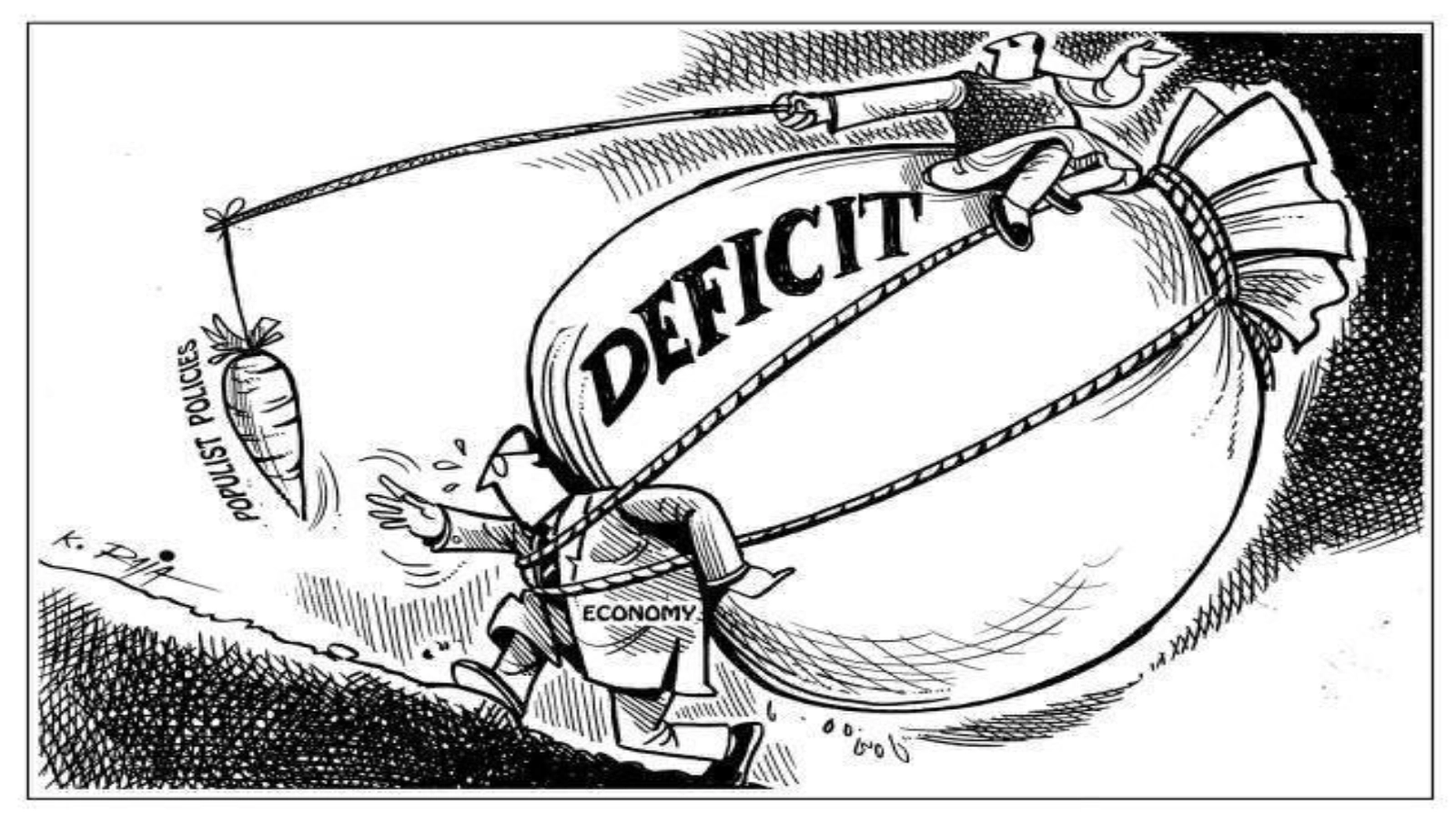

CFA Romania analysts anticipate a budget deficit of 6.8% of GDP in 2021, and public debt could reach 53% of GDP over the 12-month horizon, according to a press release from the organization.

According to the quoted source, the average value of the expectations regarding the evolution in real terms of GDP in 2021 is +7.2%.

Regarding the euro / leu exchange rate, over 87% of the survey participants predict a depreciation of the leu in the next 12 months (compared to the current value). Thus, the average value of the anticipations for the 6-month horizon is 5.0196, while for the 12-month horizon the average value of the anticipated exchange rate is 5.0672 lei for one euro.

The CFA Romania Macroeconomic Confidence Indicator decreased by 0.9 points compared to the previous month, to 73.6 points (compared to the same month of the previous year, the indicator increased by 40.3 points). The decrease was due the anticipation component of the indicator. The anticipated inflation rate for the 12-month horizon registered an average value of 4.38%.

"Against the background of the caution generated by the entry into wave 4 of the pandemic, the macroeconomic confidence indicator fell for the second consecutive month, but remains at a high level, close to the historical maximum, which indicates confidence in future economic developments. In the context of rising inflation, participants anticipate an increase in money market interest rates over the next 12 months, including at least two monetary policy interest rate increases by BNR", said Adrian Codirlasu, vice-president of the CFA Romania Association.

It is also mentioned that over 95% of the survey participants predict the increase of the money market interest rates

(ROBOR 3M), no opinion was registered to reduce this rate, and over 79% of the participants anticipate the increase of the interest rates for the maturities of 5 and 10 years.

In the context of the increased attention of the European authorities on environmental protection, attention embodied in regulations on the consideration of ESG factors (environmental, social and governance factors) by financial institutions, questions were introduced in the survey on the awareness by the financial institutions of these regulations, the preparation of the financial institutions for ensuring the observance of the new regulations, as well as the support offered to the clients for ensuring their observance.

According to the participants' answers, the main impediment in the implementation of ESG factors is the insufficiency of information, followed by the lack of expertise in this field.

The survey is conducted monthly by the CFA Romania Association, for over 10 years, and is an indicator by which the organization wants to quantify the expectations of financial analysts on economic activity in Romania for a period of one year. The survey is conducted in the last week of each month and the participants are members of the CFA Romania Association and candidates for levels II and III of the CFA exam, Agerpres informs.

Comentează