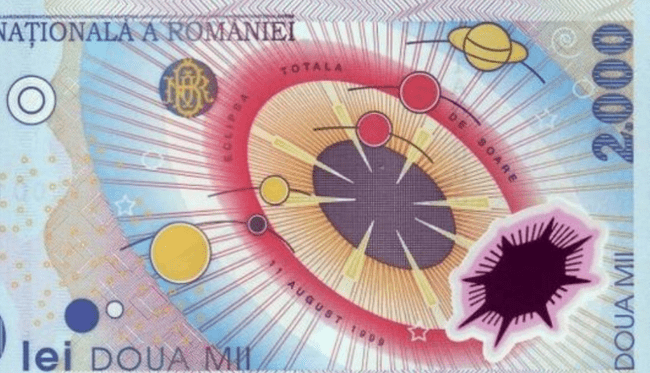

The amendments to the Tax Code have special provisions for the instances in which the tax authorities may refuse to grant Valued Added Tax (VAT) deductions in order to avoid possible abuses from them, Finance Minister Ionut Misa told a government meeting on Wednesday.

"There are explicit provisions for the instances in which the tax authorities may refuse to grant Valued Added Tax (VAT) deductions, as resulting from the case law of the EU Court of Justice. The measure is designed to clarify the situations where tax authorities can refuse to grant VAT deductions in order to avoid possible abuses on the part of the authorities (...) I think it is an extremely important measure to the Romanian business environment, a long-awaited measure. There has been a lot of talk in the public and business environment regarding the non-granting of VAT deductions for chain purchases. In fact, an honest and fair economic operator who has acquired an asset or contracted services and made a payment for these services transparently has been unable to deduct the VAT because a fourth or a fifth supplier in the chain did not pay the VAT to the state. Such a situation generated by the tax authority will be virtually impossible in the future," said Misa.

He added that another measure targets excise duties and special taxes.

"This is also about the introduction of a complementary penalty in the form of seizure of containers and means of transport used for the transport and storage of excisable products not properly labelled or marked or with false markings. The measure is extremely necessary to prevent and combat tax evasion and, at the same time, to ensure a fair competitive environment," Misa said. AGERPRES .

FinMin Misa: Under new amendments, tax authorities will be able to refuse VAT deduction

Explorează subiectul

Articole Similare

0

Retele Electrice Romania launches over 75 million RON transformer station project in Balotesti

0

2

Romania's 'cheap' gas is among the most expensive in the EU in relation to purchasing power (analyst)

2

11

Euro trades at RON 5.0943

11

9

Ministry of Finance raised 90 million lei from banks on Friday in an additional auction following Thursday's session

9

18

ForMin Toiu: Munich Security Conference hosts conversations on key topics for Romania

18

17

Italian Chamber of Deputies approves historic deal between Italy and the Romanian Orthodox Church

17

13

PSD's Grindeanu: If a Government is not for the people, then it will no longer exist at all

13

20

PM Bolojan: Temporary technical recession is part of the anticipated cost of the transition to a solid economy

20

9

President Nicusor Dan: It would have been good to have the budget before 1 January

9

17

Bucharest general mayor invited to join network of Europe's main mayors

17

23

TVR announces finalists of National Eurovision Selection

23

13

DefMin Miruta leading Romania's delegation to Munich Security Conference

13

15

Romania's economy grows by 0.6pct in 2025, but ends year on technical recession

15

Comentează