The CFA Romania Association, in partnership with Kruk Romania, launched the Financial Flow Index (IFX), with the value this year being 54, which indicates a balanced financial flow, according to a press release of the association.

A balanced financial flow means a state of relative stability, but not without risks, reflecting the current capacity of households to manage their resources in the given macroeconomic context, CFA mentions. The overall score of 54, on a scale from 0 to 100, indicates a stable sector, capable of efficiently managing the major risks in the economy and capitalising on existing opportunities.

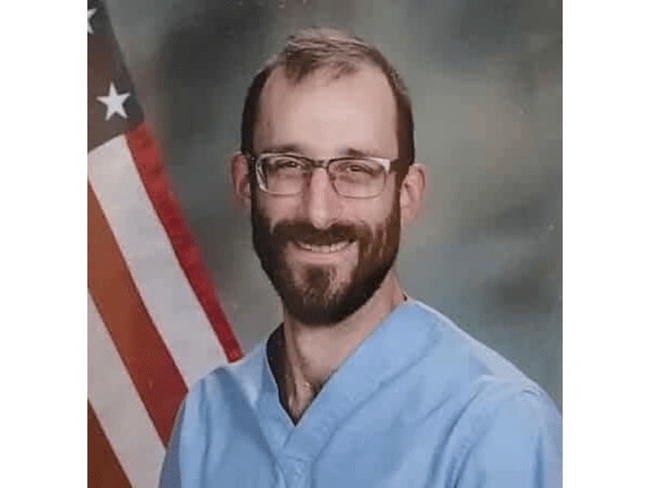

"The responses of the survey participants indicate a generally responsible financial behavior, but the capacity of households to absorb financial shocks is still limited and even lower than a year ago. In 2025, the high macroeconomic pressures overlapped the structural vulnerabilities of the population, amplifying the risks and projecting these vulnerabilities into 2026," says Andreea Nica, vice president of the CFA Romania Association.

According to the same source, Romania is financially balanced at this point, but this is fragile due to structural vulnerabilities and the macroeconomic context. Strengthening this balance depends largely on increasing the level of financial education and adopting more efficient planning tools.

The IFX value is directly influenced by 15 macroeconomic indicators, which describe a challenging environment: modest economic growth, with a GDP forecast below the European Union average (0.8%), high budget deficit (8.3% of GDP), public debt around 60% of GDP, persistent inflation (6.3% in 2026), high reference interest, at 6.5%, and an anticipated depreciation of the national currency (EUR/RON: 5.2 in 2026).

In the IFX, a series of behavioral and attitudinal indicators of the population were aggregated, highlighting a series of vulnerabilities, such as: low shock absorption capacity: 74% of Romanians say that they cannot cope with unforeseen expenses that involve spending an amount equal to 6 monthly salaries, indicating low financial resilience; low use of financial products: 21% of Romanians do not use standard financial instruments; high preference for cash: there is a clear predisposition for liquidity, with 66% of Romanians preferring to save money in cash; non-optimised budget planning: budget planning is present (45% of Romanians plan their income and expenditure budget monthly), but it is not optimised.

The survey also took into account that although Romanians are saving (58% stating this), investments are modest or almost non-existent, money being kept mainly in current accounts (53%) or cash (66%); the risk of default is low, standing at 17%, but there are vulnerable segments of the population (13% of Romanians cannot cover even the bare necessities); the level of financial education is basic to average, but there is a declared desire of Romanians to improve their knowledge in this area.

The Financial Flow Index (IFX) was developed by the CFA Romania Association in partnership with Kruk Romania, based on a complex analysis of 3 major dimensions and 15 indicators, most of them macroeconomic.

Comentează