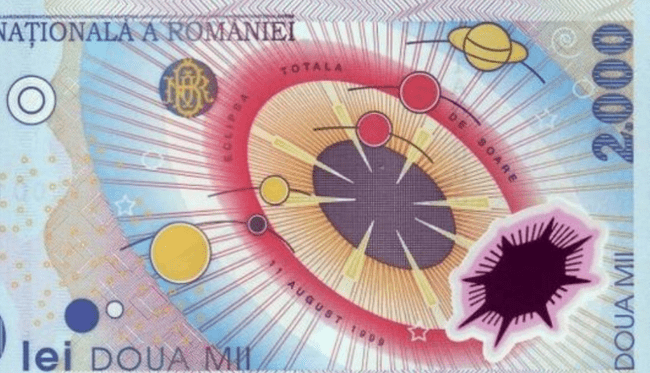

A monetary council would probably neede an exchange rate of at least 7-8 lei in Romania's case, governor of the National Bank of Romania (BNR), Mugur Isarescu, stated on Monday, while mentioning that such council is only set up in crisis situations.

"And there was another confusion! A serious one! And I guess it was him again [adviser to PM, Darius Valcov - editor's note] who posted it on the Website of the ruling party, when the exchange rate was under pressure. We were told then to follow into Bulgaria's footsteps. And of course that there were some who responded to this. But I don't believe anybody actually read the documents. It was just the idea that remained. And our research showed that it did gain the public opinion's interest and that's why we need to explain this. So, a monetary council, which comes with a fixed exchange rate, appears after a period of crisis, after a major crisis. As it happened in Bulgaria, if I am not wrong, back in 1996. During such time the currency becomes extremely weak, the population's and companies' savings become rare or are just wiped out by the depreciation, and the only solution, as inflation becomes rampant, and we are talking now about a 3 or 4-figure inflation, is to stabilize the exchange rate through a firm statement, but at a very very high level! So, first of all, we are not in crisis right now, and I believe nobody would want that, and second of all, I don't how you could just set it up out of the blue. But let's say that it can be done. A monetary council, in Romania's case, would probably be needed if the exchange rate would be 7-8 lei, at least. But is this what we need? Is this what the economic adviser to the PM promotes?," said the governor of the central bank.

Moreover, he mentioned that a monetary council immediately collapses unless the country is capable of self-discipline and has no deficit, but monetary surplus instead. He stated that Bulgaria has a budgetary surplus of 1.1 per cent.

"Which means in Romania's case that, instead of -3, we should have +1 budgetary surplus, which is about 4 per cent of the GDP, all right? But this means, just to throw a figure, for we all know how much the salaries did increase, the total of the salaries of the public employees, and also considering the large number of public employees, is worse even than in the grace year of President Basescu, with the cut by 3 per cent in the budget expenditures [3 per cent of the GDP - editor's note]," said Isarescu.

Moreover, Isarescu specified that, if BNR intervened on the foreign currency market and sold foreign currencies attracting lei, as suggested, the interest rates would have reached 15-20-30 per cent.

BNR's Isarescu: A monetary council would probably need an exchange rate of at least 7-8 lei

Explorează subiectul

Articole Similare

7

President signs degree on judge Ionela Tudor's retirement

7

9

President Dan: Governing coalition works better than generally perceived

9

13

President Dan: The European Commission has committed to come up with proposals on lowering energy prices

13

12

President Dan: For each of the three prosecutor's offices there are very interesting picks

12

22

EnerMin Ivan:Final Investment Decision for Doicesti SMR marks transition from analysis implementation phase

22

8

ANAT vice-president: Romanian tourism is in technical recession

8

17

ECA's Romascanu: Romania has a relatively comprehensive RRF anti-fraud framework

17

8

Bucharest Stock Exchange closes higher in Thursday's trading session

8

7

Gov't spokesperson admits it's a difficult period for citizens, but essential for budget balance

7

9

Protest in Timisoara against postponement of Constitutional Court's decision regarding magistrates' pensions

9

10

The EP's view on cyberbullying and how realistic Romanian MEPs consider the proposed solutions

10

8

USR MPs call on European Justice Commissioner for more rigorous Rule of Law assessment

8

11

DefMin Miruta: National defense industry must be part of international production chains

11

Comentează