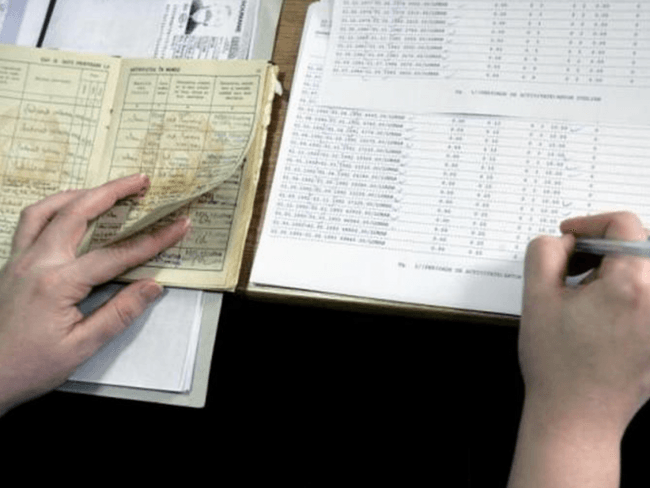

Romania is no longer among the countries that experience the widening of the tax gap, said the National Tax Administration Agency (ANAF), referring to the European Commission's recent VAT Gap report.

For Romania, the figures show that the fiscal gap remained approximately steady at 35.8 percent in 2016 and 35.5 percent in 2017 (the numbers are rounded off to 36 percent for both years). Some member states have seen a tax gap growth compared to 2016: Greece - by 2.6 percentage points, Latvia - by 1.9 percent, and Germany - by 0.2 percent, but Romania is no longer among the countries with a widening tax gap, ANAF said in a release.

"It is for the first time in 5 years of analysis of the VAT gap when Romania is no longer among the EU member states with the largest tax gap increase among the 28 member states of the European Union," ANAF representatives show.

"One of ANAF's priority concerns is the reduction of the VAT gap, with the measures enforced with a view to achieving this goal included in the Plan of Measures for Improving the Collection of Revenues to the General Consolidated Budget, developed in June this year and published on the agency's website," mention the representatives of the tax authority.

According to the cited source, in the first eight months of 2019, VAT revenues are 11.6 percent higher compared to 2018, and VAT refunds to taxpayers increased by 8.7 percent

Tax authority: Romania no longer among EU states to experience tax gap widening

București 3°C

3°C

Articole Similare

3

Middle East crisis/Romania requests through RescEU Mechanism approximately 5 flights on Dubai/Muscat-Bucharest/Romania route

3

11

After extensive analysis of appointments to prosecutor's offices, I disagree with what is on social media (President Dan)

11

6

Nicusor Dan on repatriation of Romanians from Middle East: Romanian state controls the situation

6

7

Nuclear elements being in our space is out of the question (President Dan)

7

11

In global operation, police track down five Romanians involved in selling access credentials

11

11

Not best management and not enough capital - shortcomings of our economy (President Dan)

11

7

Romania and Poland can take advantage of having common vision in many areas (President Dan)

7

10

President Dan, PM Tusk agree to increase defence cooperation within NATO

10

13

Foreign Ministry confirms Russia sentenced Romanian citizen for espionage

13

11

Gov't approves IBRD loan of up to EUR 300 million for energy projects

11

5

HealthMin Rogobete:We are including four more Emergency Departments in direct financing from state budget

5

9

Romania's current fuel reserves can cover five months' worth of demand in case of severe dearth

9

7

Abrudean: Capping gas price for household consumers, a timely decision

7

Comentează