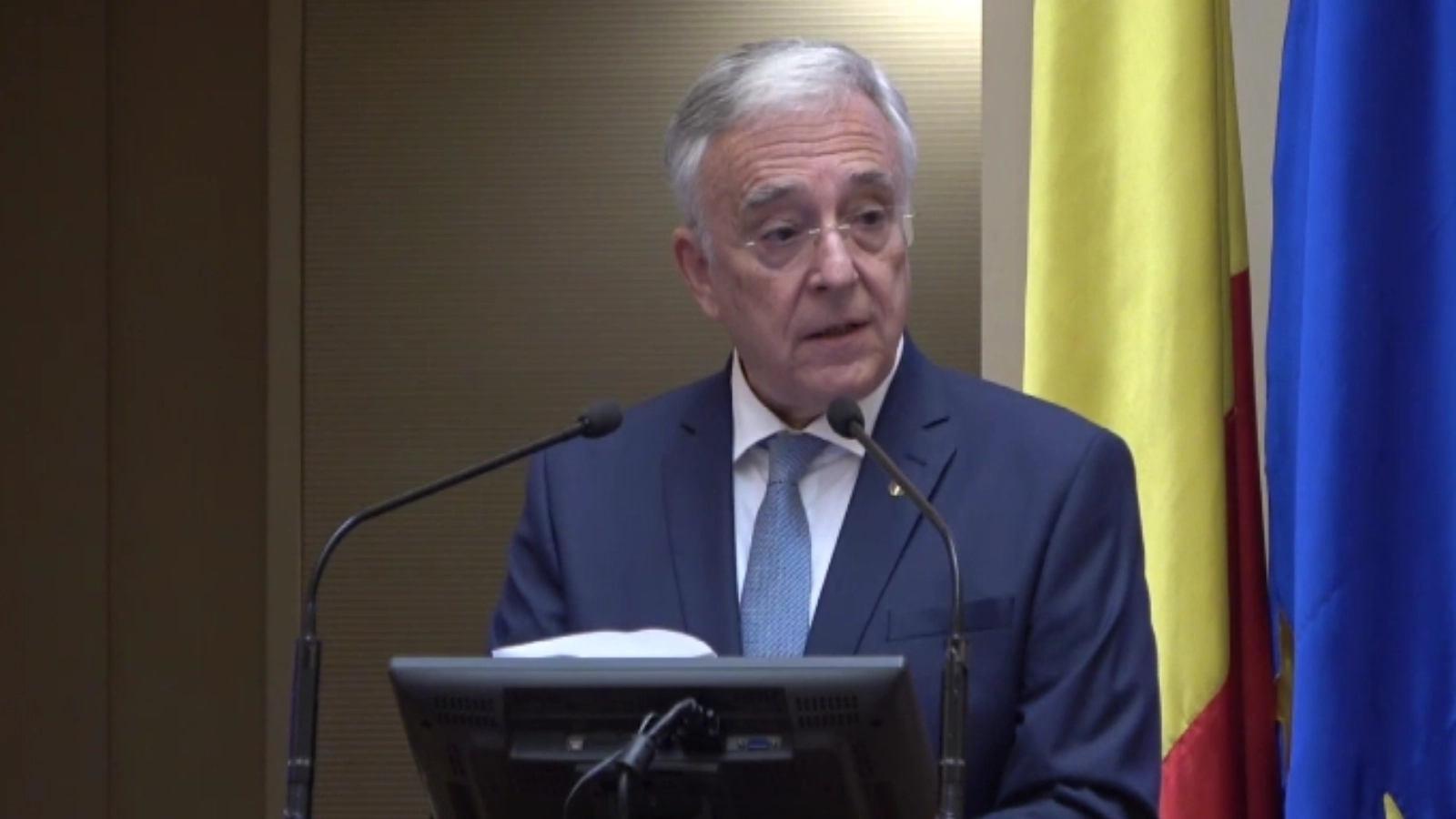

The fact that it has become customary practice for bills to enter debate without an impact assessment should set us thinking, National Bank governor Mugur Isarescu on Friday told the conference "Financial Inclusion - From Speech to Deeds", stating that back in the '90s a bill would not have reached Parliament unless accompanied by an impact assessment report.

"The fact that laws are now being discussed without an impact assessment report should set us thinking. Coming up with a law that says 'that's my understanding of how things are in the European Union' is not enough. In the first place you should take a look at what the European Union really is, because it is not standardized in financial and banking terms, there are many divergences and differences. And then I would ask this: what's the distance from saying that we want lending in Romania to be like in the European Union to proposing a law according to which Romania's standard of living should be like in the European Union? They are just a few steps apart and we'll live to see a law stating that we must live equally well as in the European Union," said Isarescu.

He said that stakeholders who see to the public's financial education must take this reality into account.

The governor of the central bank said it was dangerous to speak just inside institutions and the messages not make it outside the building walls, because the broad population must have financial knowledge to cope with the complexity of today's financial products, but also with the complexity of everyday life.

Otherwise, at any time the rules of an operation could be bent to justify a failure, with the loan getting to no longer be a loan, but a kind of donation on a single-sided consent, under the argument that it is not repaid, therefore it is no longer credit because the borrower did not understand what it was about. Such an approach, such an imbalance would completely blow up the financial mechanisms, destroy the lending market and create chain problems in the functioning of the market economy, Isarescu argued.

AGERPRES .

Comentează