The risk of non-repayment of loans contracted by the non-government sector is on the rise, in the current Report on financial stability issued by the National Bank of Romania (BNR), vs the previous report where it used to be presented as moderate, the central bank's Vice Governor Liviu Voinea, told on Thursday a presentation conference of the said document.

'The main risk is the setback of the investors' confidence in the emerging economies. This was also present in the previous report as a high risk, and yet this time the outlook is growing. Moreover, a high risk is the risk of non-repayment of loans contracted by the non-government sector. It is a risk on the rise against the previous report, where it only appeared as a moderate systemic risk. Some other two moderate systemic risks this time, similar to the previous report are: the straining of macroeconomic balances and the low pay discipline in the economy, with respect to the existence of certain vulnerabilities in the companies' balance sheet. Finally, a small systemic risk, but worth mentioning, refers to the increase of the real estate prices, it being connected or linked to the risk of non-repayment of loans contracted by the non-gov't sector. Besides, all these risks are not isolated, they determine and augment each other,' Liviu Voinea said.

According to the report, the risk of non-repayment of loans contracted by the non-gov't sector is assessed at a high level, in particular with regard to the population.

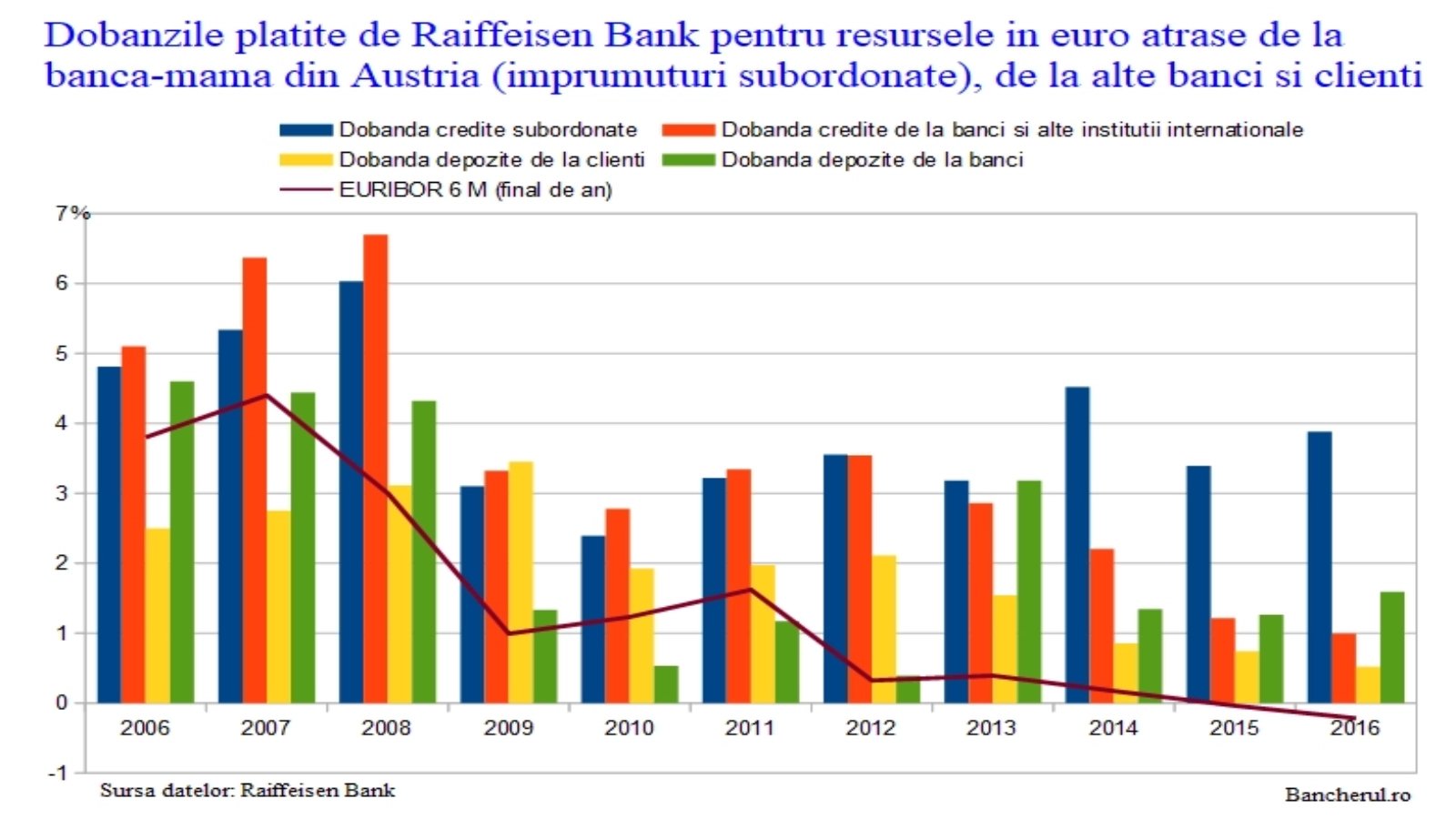

Although the non-performing loans' rate continued its downward slope at the level of the population sector, this dynamic has been determined by an important basic effect generated by the more marked rise of the loans, whilst the non-performing loans' volume given to this segment in the national currency re-entered an ascending path, up by 13 pct (March 2018 vs March 2017). The fiscal measures to limit the banks' tax deductibility, which influence the furthering of the resolution process of the non-performing loans, corroborated with the modification of the interest rate's trend related to the national currency, in the context of an international interest rates' increasing cycle and of slashing the quantitative relaxation programmes, represent the main influence factors.

Moreover, the document mentions that the population's total debt continued to grow during 2017 in nominal terms, its evolution being determined mainly by the important increase of the mortgage bank credit and the IFN (non-banking financial bodies) loans. At the same time, the growing dynamic at the consumption credit's level given by the banks and the IFNs was also noticed. The increase of the credit was mainly determined by the growth of the median value of a loan, regardless of its destination, the number of loans contracted being even smaller.

According to BNR, in the first three months of 2018 the non-performing loans volume grew (+0.8 pct), and by the end of the year the average non-repayment probability is forecast to grow on both the mortgage bank credits and the consumption ones. agerpres

Risk of non-repayment of loan contracted by non-government, on the rise

Explorează subiectul

Articole Similare

3

Romania, Republic of Moldova discuss measures to streamline border traffic

3

5

World Obesity Day/Study: 27.5% overweight prevalence among 7-year-old children and 32% in 8-year-olds

5

7

Carriers urge Government to halve excise duties on diesel and petrol

7

7

US, Moldova envoys among diplomats presenting credentials to President Nicusor Dan

7

6

AVR: Average border waiting times for freight transport between 31 and 36 minutes in 2025

6

3

Unemployment rate drops to 6pct in January, while youth unemployment stays high, at over 28pct

3

8

Cristian Radu Nema's album "PHOENIX - The Story Without Words" wins Culture Awards prize

8

8

Iranian Charge d'Affaires Javad Karimi called to MAE: Protest over attacks on neighbouring states in Middle East

8

20

Iranian Charge d'Affaires called to MAE: Protest over attacks on neighbouring states in Middle East

20

13

Romania showcases Via Transilvanica and Banat gastronomy at ITB Berlin

13

14

'Detector for Life' campaign - a life-saving initiative, IntMin Predoiu says

14

27

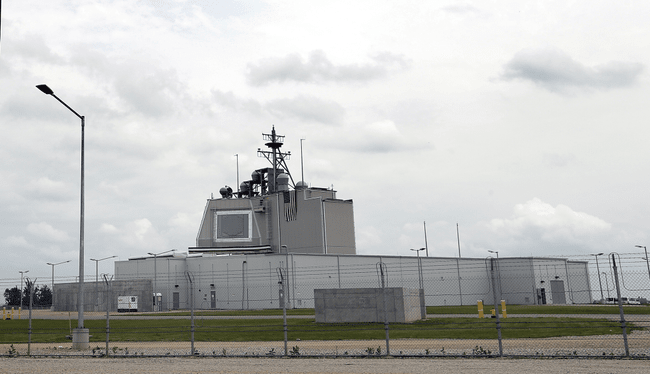

Romania in talks over France's proposed nuclear umbrella (sources)

27

27

Moldova to introduce deposit-return system for packaging in 2027 (Environment official)

27

Comentează