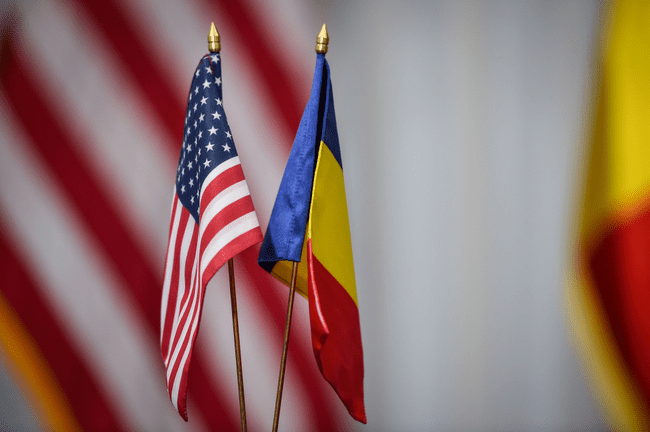

The Development Bank of Romania (BDR) will be able to start its activity after the European Commission will issue an authorization decision in the matter of state aid and after obtaining the operating authorization issued by the National Bank of Romania, a draft Government Decision published Tuesday by the Ministry of Finance reads.

The initial share capital of the bank subscribed by the shareholder, through the Ministry of Finance, is up to 3 billion RON, which will be provided from the revenues from privatization, with the exception of the amount representing the equivalent of 10 million euros, which will be paid from the state budget. In order to expand its operations, BDR will have to attract external sources of financing.

"BDR will be a credit institution owned 100% by the Romanian state, through the Ministry of Finance, with the role of a development institution that will serve Romanian companies and other entities belonging to the public and private sector in Romania, in order to support the financing of projects which contributes to the economic and social development of the country, increasing competitiveness, innovation and economic growth, as well as increasing the absorption of European funds," the explanatory note accompanying the draft piece of legislation says.

According to the Ministry of Finance, the Development Bank of Romania will improve the financing offer for key sectors and investments in projects in innovative, ecological and social fields, in which market dysfunctions have been identified, with a positive impact on the growth of investments in the economy and employment.

The Bank's strategic objectives are facilitating access to financing for SMEs, ensuring access to financing for viable infrastructure projects, attracting private capital in investments and improving the absorption of European funds and the associated multiplier effect and functioning as an administrator of European funds and providing technical assistance.

BDR will use a wide range of financial products: individual guarantees and portfolio guarantees, loans for financing working capital and investment projects, loans for energy efficiency, and to the extent that its capacity and financial strength will be strengthened and the staff will acquire specific expertise and knowledge, BDR will be able to also include in the range of products, instruments of capital investments (equity type).

"Through the range of financial products offered, BDR will not enter into competition with credit institutions, but will act in a complementary manner with them, having the obligation to apply the mechanism to prevent the phenomenon of crowding out of private financial institutions that will be described in the constitutive act," the source says.

At the time of the start of operation, the bank will take over from Banca de Export-Import a Romaniei Eximbank - SA the responsibilities of the Investment Fund of the Three Seas Initiative, together with the participation in its capital and the funds related to the participation in the activity of the Fund and the actions initiated by its actions, in order to promote the projects advanced by Romania.AGERPRES

Comentează