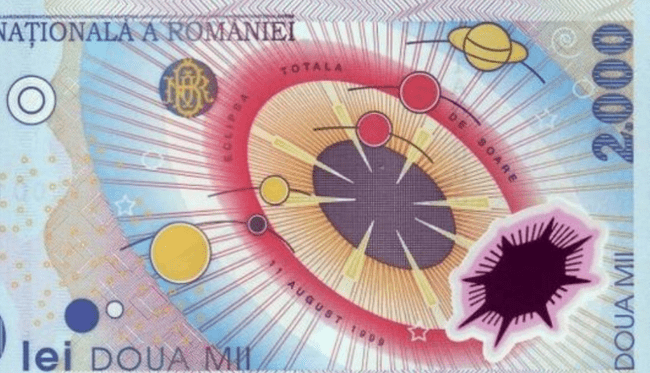

The Romanian banking sector has values significantly above the European average in terms of solvency and liquidity, Deputy Director within the Financial Stability Department of the National Bank of Romania (BNR) Florian Neagu stated on Thursday, told Agerpres.

"I believe that there are several things that we, at the National Bank, are doing to support entrepreneurs. Firstly, we make sure that the banks have enough liquidity and enough capital for the lending activity to continue under normal conditions. And looking at standard indicators in monitoring this objective, both on solvency and liquidity, the Romanian banking sector has values significantly above the European average. Looking at how much Romanian banks lend, there are many nuances. First of all, I would start with the structural elements, when we have in Romania the lowest level of financial intermediation of Europe. Therefore, lending to companies and lending to the population are the lowest, in relation to the GDP," Florian Neagu told the conference called "Macroeconomic indicators of systemic insolvency. Realities and solutions for recovery," organized at the Chamber of Commerce and Industry of Romania.

The second element he mentioned was an industrial policy that can orient the state's resources in one direction and, this way, the creditors would also orient their resources because they know that this is the vision of the Romanian state. He mentioned that the Czech Republic, Poland or Hungary have such policies.

Moreover, the BNR official stated that the topic of insolvency has been and still is on the radar of the National Bank, but also on the radar of European institutions for some time.

According to him, at the European level, it was estimated that the number of insolvencies shall experience a significant increase in the context of the pandemic. This has not happened because the authorities of almost all countries have consumed significant resources to endorse the real economy. This support led to a significant increase in debts. And, besides this development that we meet in almost all countries, Romania is also characterized by several imbalances: the fiscal deficit and the current account deficit.

"The experience of the last century at international level shows that, when these imbalances are manifested in a country, the fiscal deficit and the current account deficit, the probability of them translating into the real economy by increasing the number of insolvencies increases significantly," Neagu added.

Comentează